Welcome to AfricaX Trading, your gateway to a new era of agricultural trade factoring. We are a peer-to-peer electronic trade factoring service that provides trade financing and facilitation services for physical commodities. Whether you are an experienced trader or a budding entrepreneur, our innovative platform is designed to empower you with the resources and opportunities you need to thrive in the dynamic African market.

Mission & Vision: Transforming African Trade with Innovation

At AfricaX Trading, our mission is to foster inclusive and sustainable economic growth across Africa by leveraging advanced tools and technologies in the field of trade finance. We aim to create a seamless ecosystem that connects traders, investors, and stakeholders, enabling them to finance, optimize, and maximize the potential of inter-African trade.

Driven by our vision, we are actively exploring the opportunities presented by the African Continental Free Trade Area (AfCFTA). Through strategic partnerships and cutting-edge data products, we aim to unlock the full potential of this historic initiative, empowering businesses to thrive in a borderless, interconnected African market.

Live Market Data Feed: Real-time Insights for Informed Decision-Making

Stay ahead of the game with AfricaX Trading's live market data feed. We provide our traders with real-time market price data feeds for a wide range of commodities, including grains, fresh produce, and more. With our comprehensive insights into various markets in Africa, you can make informed decisions and seize lucrative trading opportunities.

In addition to real-time market price data, we also offer alternative data feeds and analyzed insights on overall market trends and news. Our order book provides current buy/sell (bid & ask) orders available in the given market, allowing you to navigate the trading landscape with confidence.

What AfricaX Trading Does: Empowering Traders and Investors

Market Making |

Business Development |

Investment Analytics |

| Our experienced team applies advanced market-making strategies to optimize trade execution. We provide buy/sell side planning, order flow/book management, and trade facilitation/execution services, ensuring efficient and profitable trading experiences. | Unlock the full potential of your business with our comprehensive business development services. We offer strategy stress-testing, risk management, and money management solutions to help you stay ahead of the curve and navigate the complexities of the market. | Gain valuable insights and optimize your investment strategies with our cutting-edge investment analytics services. Our team of experts specializes in portfolio optimization, machine learning, and algorithm development to maximize your returns and mitigate risks. |

Trade Staking: Revolutionizing Contract Financing

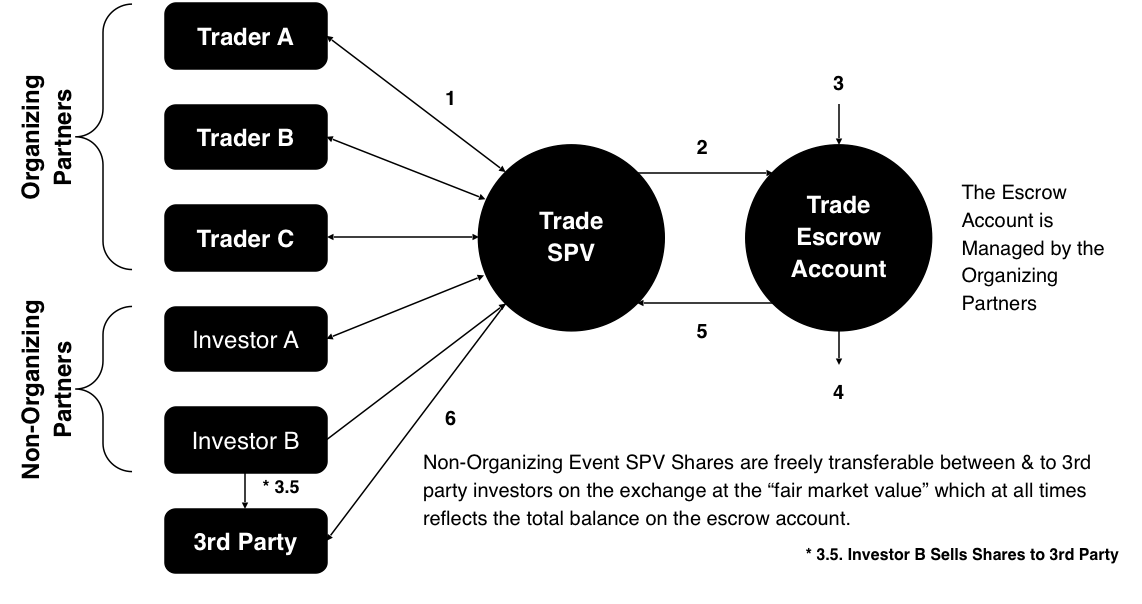

Experience the power of collaborative financing with AfricaX Trading's innovative approach called "Trade Staking." Trade staking allows multiple traders and investors to invest in a trade, with the aim of generating a positive return on investment from the proceeds of the trade.

"Trade staking is the game-changer that redefines how contracts are financed in the African market. It aligns stakeholders, encourages profit maximization, and paves the way for a more prosperous future."

Here's how trade staking works:

- Traders and investors, through a licensed broker/custodian, buy shares of the contract Special Purpose Vehicle (SPV) on offer through a regulated financial center or public/private exchange.

- The exchange transfers funds onto a protected escrow account, ensuring the security of the trade.

- All revenue and expenses related to the trade, including client payments, supplier/farmer payments, and logistics fees, run through the escrow account.

- At the end of the trade, the escrow account is closed, and the total balance is transferred to the broker/custodian.

- The proceeds are then dispersed proportionally to all shareholders, including third parties who bought shares from non-organizing investors after the initial offering.

Example: Sugar-31 (Masavu)

Let's take a closer look at an example to illustrate the potential of trade staking:

- Product: Sugar-31 (Masavu)

- Quantity: 1000 mt

- Strategy (Delivery & Payment Schedule/Logistics): 10 Lots of 100 mt

- Investment Required Per Lot: UGX 265,000,000

- Expected Payout Per Lot: UGX 270,000,000

- Spread (Expected Profit) Per Lot: UGX 5,000,000

- Price Guaranteed: Yes/No *

- Supply Guaranteed: Yes/No *

* It is determined on a contract by contract basis if Price is Guaranteed (Yes/No), and if Supply Guaranteed (Yes/No) ? ... Resulting in changes to each contracts risk profile.

In this example, traders and investors can buy shares of the trade SPV Initial Offering for UGX 1,000 per share. Throughout the trade, the escrow account ensures transparency and secure transactions.

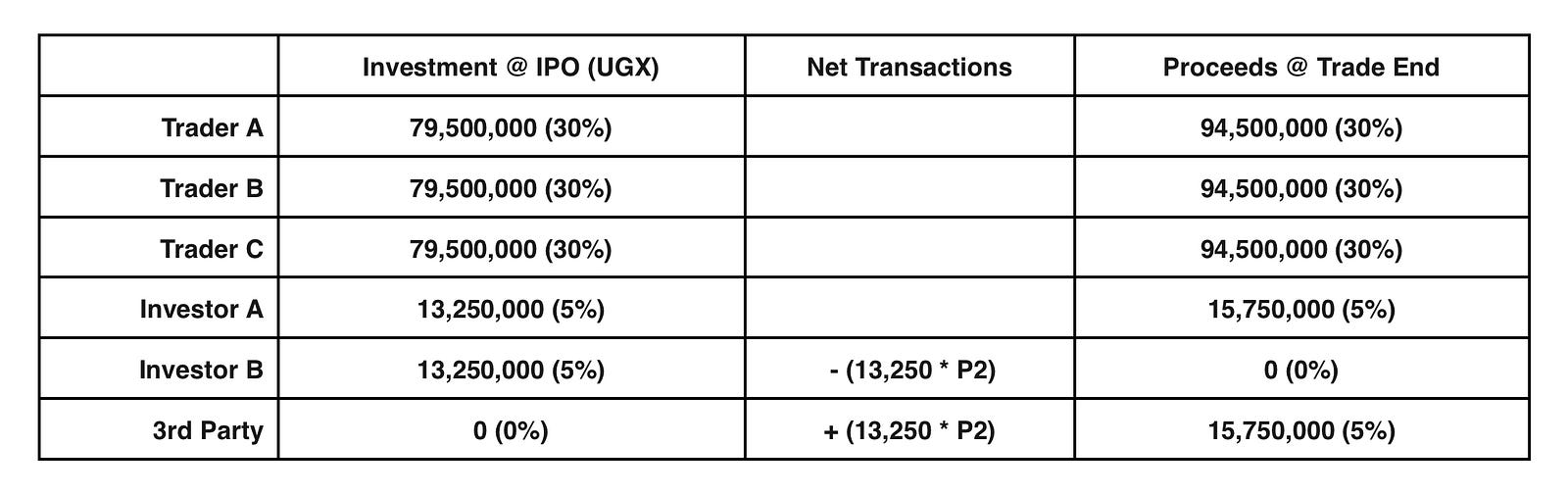

Example of Mid-Trade Transfer of SPV Shares:

- @ Trade SPV Initial O: 265,000 Shares @ Price Per Share = UGX 1,000

- Investor B Sells Shares to 3rd Party

- Total Escrow Account Balance at the End of Trade: UGX 315,000,000 / 265,000 Shares = UGX 1,188.67924 (+18.87%)

At the end of the trade, the total balance is divided equally among the shareholders, providing an expected return on investment of 18.87%.

Fee Structure / Revenue Model: Transparent and Competitive Pricing

At AfricaX Trading, we believe in transparency and competitiveness when it comes to our fee structure. We differentiate fees based on trade orders that provide liquidity ("maker orders") and those that take away liquidity ("taker orders").

Our maker fees start at 2.00% but can be as low as 0.00%, incentivizing liquidity provision in the market. Taker fees also start at 2.00% but can be as low as 0.10%. All market orders, including conditional orders that convert to a market order, will be executed immediately and charged the taker fee.

For traders who want to ensure their limit orders are charged the maker fee or canceled, we offer the option to use the Post Limit Order feature. As a market maker, we charge a base commission per trade in addition to the maker/taker fee, ensuring a fair and sustainable revenue model for our platform.

.png?width=100&height=100&name=AfricaX%20(1).png)